The Nasdaq Golden Dragon China Index, which tracks major Chinese companies traded on US exchanges, fell more than 14% after being down as much as 20% during the session.

E-commerce player Pinduoduo ended with a drop of more than 24% after tumbling 30%, while bigger rivals Alibaba Group Holding and JD.com plunged 12.5% and 13%, respectively. Electric-vehicle makers Li Auto, Nio and Xpeng all sold off by double digits.

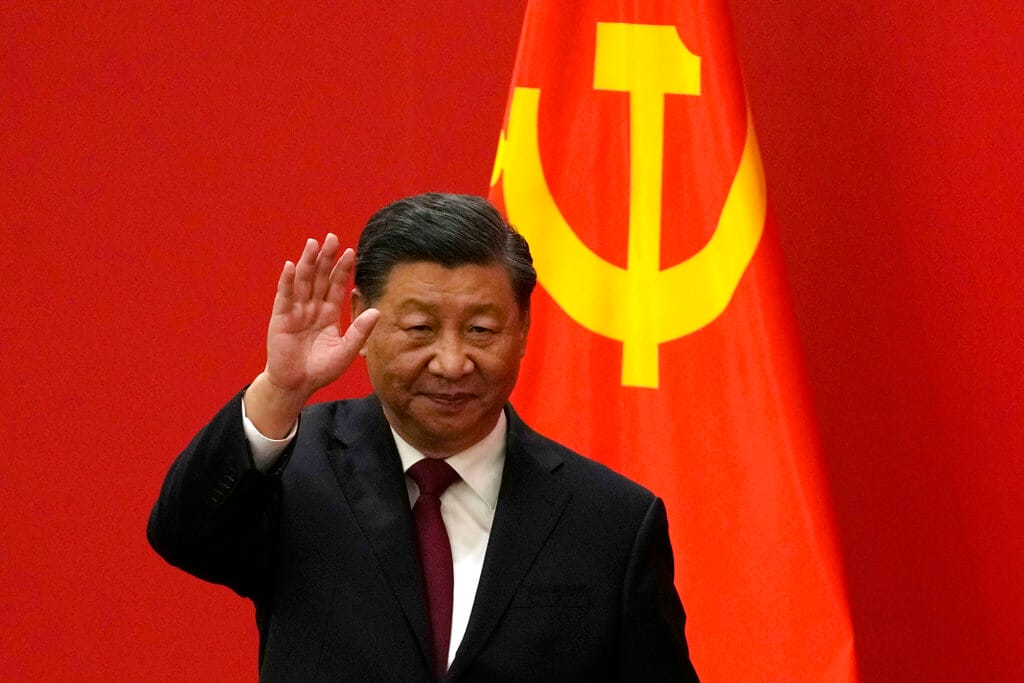

Hong Kong and mainland Chinese shares also took a dive after President Xi Jinping tightened his grip on power at the twice-a-decade Communist Party congress that concluded over the weekend.

The Hang Seng Index closed down more than 6% to 15,180.69, reaching a 13-year low. Shares in Alibaba and Tencent Holdings each fell more than 11%. The Hang Seng technology index sank more than 9.6%.

On the mainland, the China CSI 300 closed down 2.93%, while Shanghai’s SSE Composite Index lost 2.02%. The food and beverages and beauty care sectors led the drop.

The declines follow the conclusion of China’s 20th National Party Congress, where leaders who will set the country’s economic and political policies for the next five years were announced. Xi secured a precedent-breaking third term in office and has stacked the Politburo Standing Committee, the country’s highest decision-making body, with loyalists.

“The new leadership indicates more concentration in the top decision-making procedure,” a report published on Monday by Bank of America said. “Some investors may worry about the lack of checks and balances and the risk that potential policy mistakes evolve into major shocks to the economy.”

The report adds: “The future of the Covid Zero policy remains an open-ended question. Now with power more concentrated at the top, this decision hinges even more on President Xi’s views.”

Mike Leung, an investment manager with Hong Kong’s Wocom Securities, said foreign investors appeared disappointed at the new members of the Politburo Standing Committee, with some believing China would continue its zero-Covid policy, hobbling the economy.

“I think it’s extremely hard to restore market confidence at this stage,” Leung said.

The yuan also weakened to a 14-year low to past 7.3 per U.S. dollar on Monday amid growing concern that China would not soon lift its stringent zero-Covid policy.

As of Monday, 28 Chinese cities are under various levels of lockdown measures, affecting around 207.7 million people, according to a Nomura estimate. The total weighted sum of areas under lockdown represents 8.5% of China’s total GDP, Nomura’s chief China economist Ting Lu wrote in a note.

The zero-Covid policy, as Beijing’s approach to containing the pandemic is known, includes widespread lockdowns and mass testing to combat even small outbreaks.

Also on Monday, China announced its third-quarter gross domestic product figure, a week later than originally planned. The 3.9% year-on-year growth beat the median forecast of 3.2% by economists in a recent Nikkei survey. The result is also better than the 0.4% growth in the second quarter, which was affected by a two-month-long lockdown in the financial hub of Shanghai.

Mark Greeven, a professor of innovation and strategy at the IMD Business School in Switzerland and Singapore who studies Chinese tech companies, said Monday’s market moves might be an “emotional response” by mostly foreign investors, as most of China’s leading tech companies are listed in Hong Kong.

“What the Chinese tech sector needs most is clarity, clarity of what is going to happen to them,” he said. “But it is not reasonable to expect that the party congress will come with clear policy guidelines.

“So an informed investor will understand that what really matters is the decision-making process after this … which will give a lot more direction of what’s going to happen with the tech sector.”