Rakuten Trade Sdn Bhd vice-president of equity research Thong Pak Leng reckoned the persistently high rates and yields have played a central role in steering the stock market for months, causing a downturn in investment prices, slowing economic activity and increasing pressure on the financial system.

“Having said that, we believe the benchmark has remained oversold and expect it to stage a rebound anytime soon, backed by a consistent influx of foreign buying support.

“On a technical perspective, the FTSE Bursa Malaysia KLCI (FBM KLCI) Index has declined for four consecutive days, hinting at profit-taking activities and a possible continuation of lower prices,” he told Bernama.

Nonetheless, Thong opined that the outlook for Malaysian equities will remain stable, supported by their attractive valuations, stronger corporate earnings, and improved economic conditions.

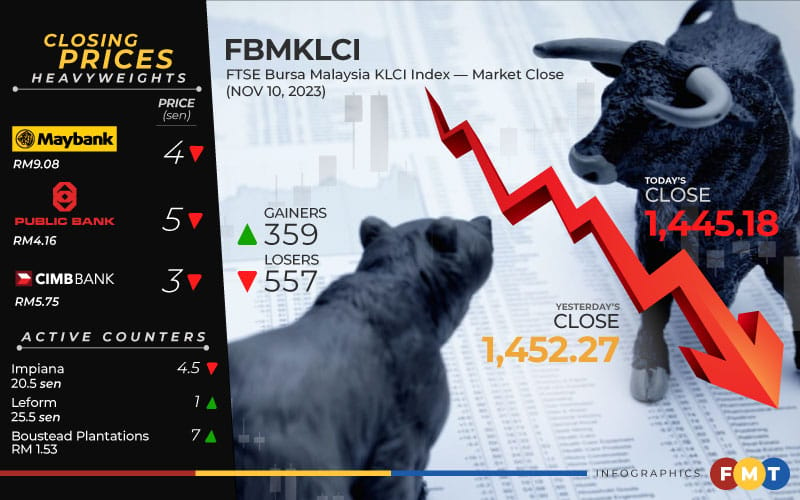

At 5pm, the FBM KLCI fell by 0.48%, or 7.09 points, to close at 1,445.18 from yesterday’s closing of 1,452.27.

The index opened 1.71 points easier at 1,450.56 and moved between 1,425.01 and 1,451.22 throughout the day.

On the broader market, decliners trumped gainers 557 to 359, while 437 counters were unchanged, 1,021 untraded, and 20 others suspended.

Turnover narrowed to 3.19 billion units valued at RM1.61 billion from yesterday’s 3.32 billion units valued at RM1.94 billion.

Among the heavyweights, Maybank lost 4 sen to RM9.08, Public Bank fell 5 sen to RM4.16, CIMB decreased 3 sen to RM5.75, and Petronas Chemicals was 1 sen lower at RM7.19, while Tenaga Nasional added 2 sen to RM9.92.

Of the actives, Hong Seng and Widad were flat at 4.5 sen and 45.5 sen, respectively, and Impiana slid 4.5 sen to 20.5 sen, Leform gained 1 sen to 25.5 sen, and Boustead Plantations rose 7 sen to RM1.53.

On the index board, the FBM Emas Index trimmed 51.56 points to 10,691.47, the FBMT 100 Index shed 50.98 points to 10,353.59, the FBM Emas Shariah Index fell 48.71 points to 10,897.17, the FBM 70 Index tumbled 70.56 points to 14,161.93, and the FBM ACE Index slipped 26.58 points to 5,132.65.

Sector-wise, the industrial products and services index went down 0.72 of-a-point to 172.4, the plantation index dropped 1.1 points to 6,922.29, the energy index dipped 2.19 points to 859.34, and the financial services index dwindled 69.44 points to 16,296.07.

The Main Market volume was marginally lower at 2.11 billion units worth RM1.37 billion compared with yesterday’s 2.26 billion units worth RM1.71 billion.

Warrants turnover rose to 385.17 million units valued at RM51.22 million from 370.43 million units valued at RM53.15 million yesterday.

The ACE Market volume improved to 677.09 million shares worth RM184.83 million from 665.88 million shares worth RM178.7 million previously.

Consumer products and services counters accounted for 504.68 million shares traded on the Main Market, industrial products and services (360.06 million); construction (102.17 million); technology (463.84 million); SPAC (nil); financial services (34.39 million); property (170.6 million); plantation (63.77 million); REITs (5.9 million), closed/fund (8,000); energy (116.15 million); healthcare (67.91 million); telecommunications and media (25.63 million); transportation and logistics (90.32 million); and utilities (100.62 million).

On a separate note, Bursa announced that the exchange and its subsidiaries will be closed on Monday, Nov 13, 2023, in conjunction with the Deepavali public holiday.

Monday is a replacement holiday for Deepavali which falls on Sunday, Nov 12.

“Bursa and its subsidiaries will resume operations on Tuesday, Nov 14, 2023.