Meanwhile, Public Investment Bank Bhd said the FTSE Bursa Malaysia KLCI (FBM KLCI) is anticipated to tread sideways around the 1,455 horizons in the near-term, swaying with market sentiment at this juncture.

In addition, another dealer said the market movement is likely to be quite slow approaching the year-end, with slow inflow from both retail and institutional investors.

“Moreover, despite the upbeat sentiment on Wall Street, some investors like to worry that the market may be overly optimistic, which could lead to disappointment if the US Federal Reserve starts cutting rates later than expected,” he said.

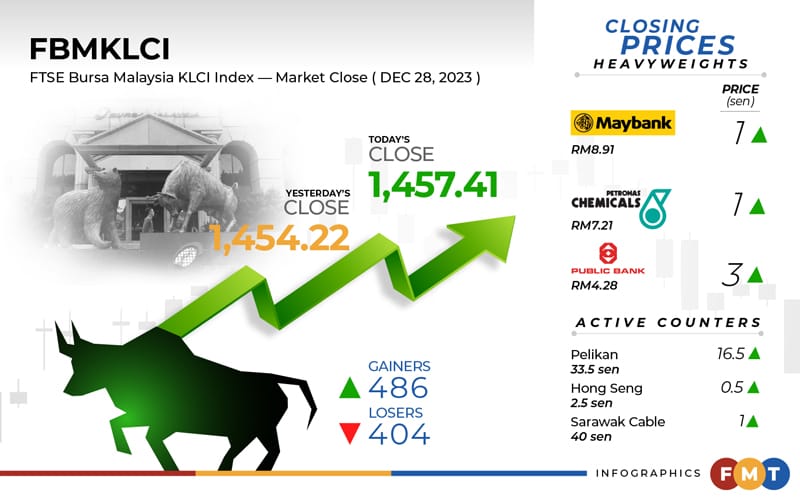

At 5pm, the FBM KLCI closed 3.19 points or 0.22% firmer to 1,457.41 from yesterday’s close of 1,454.22.

The FBM KLCI opened 0.36 of-a-point easier at 1,453.86 and moved between 1,453.06 and 1,459.10 throughout the day.

In the broader market, gainers surpassed losers 486 to 404, while 466 counters were unchanged, 945 untraded, and 86 others suspended.

Turnover went up to 4.24 billion units worth RM2.39 billion from 3.29 billion units worth RM2.06 billion yesterday.

Among the heavyweights, Maybank and Petronas Chemicals gained 1 sen to RM8.91 and RM7.21, respectively. Public Bank expanded 3 sen to RM4.28, CIMB edged up 4 sen to RM5.84, and Tenaga Nasional was unchanged at RM10.00.

Of the actives, Pelikan advanced 16.5 sen to 33.5 sen, Hong Seng rose 0.5 sen to 2.5 sen, Sarawak Cable improved 1 sen to 40 sen, VSolar up 5 sen to 22.5 sen, and Minetech eased 0.5 sen to 15 sen.

On the index board, the FBM 70 Index went down 2.57 points to 14,627.14, the FBM Emas Shariah Index shrank 4.77 points to 11,023.73, while the FBM Emas Index rose 18.02 points to 10,843.62, the FBMT 100 Index advanced 16.67 points to 10,503.07 and the FBM ACE Index added 62.37 points to 5,271.75.

Sector-wise, the plantation index decreased 1.02 points to 7,017.31, the property index eased 0.36 of-a-point to 864.16, and the energy index weakened 2.21 points to 819.97.

Meanwhile, the industrial products and services index put on 0.25 of-a-point to 172.87, and the financial services index garnered 82.43 points to 16,297.52.

The Main Market’s volume widened to 2.83 billion units valued at RM2.06 billion against two billion units valued at RM1.79 billion yesterday.

Warrants turnover increased to 481.6 million units worth RM64.44 million from 466.22 million units worth RM61.49 million yesterday.

The ACE Market’s volume climbed to 913.45 million shares valued at RM265.69 million versus 810.65 million shares valued at RM212.73 million previously.

Consumer products and services counters accounted for 540.97 million shares traded on the Main Market, industrial products and services (927.92 million); construction (184.04 million); technology (432.19 million); SPAC (nil); financial services (79.47 million); property (245.49 million); plantation (14.91 million); REITs (7.23 million), closed/fund (38,500); energy (182.25 million); healthcare (96.89 million); telecommunications and media (23.61 million); transportation and logistics (34.18 million); and utilities (64.13 million).