The recalibrated Budget 2016 was tabled by Prime Minister and Finance Minister Najib Razak on January 28 after several factors necessitated the revision of the original budget.

The price of crude oil fell to a record seven year low below USD$40 per barrel in December 2015, a trend that is expected to continue in 2016. This resulted in Malaysia’s GDP growth reduced to 4.7 per cent as compared to 4.9 per cent in mid-2015.

The prime minister announced a few measures to manage the economic slowdown and encourage consumer spending, essential steps to spur the country’s economic growth.

One of the measures was to reduce Employees’ Provident Fund (EPF) contributions from 11 per cent to 8 per cent, from March 2016 to December 2017 although the option to remain with the current deduction of 11 per cent is still open.

The prime minister said the measure was expected to increase private consumption to RM8 billion.

How does one decide between 8 per cent or 11 per cent?

The above move does not affect non-tax payers very much. This represents an individual with family earnings of RM4,000 or less per month. With the deduction of 3 per cent, they will have about RM120 per month and RM2,640 for the two years.

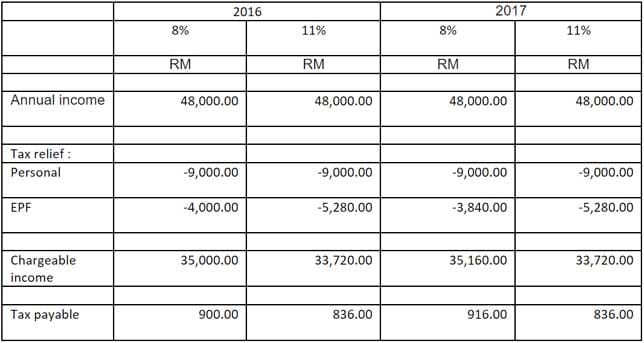

For an individual with the same salary, it may be worthwhile to look at the comparative analysis below:

Assumption: * No changes in income tax rate for the two years

The lower deduction will give a lower tax relief on EPF deductions resulting in a slightly higher income tax payment.

What does this mean to your investment in EPF?

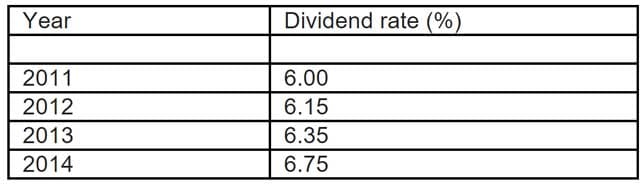

The dividend rate declared by EPF in the last four years:

Using an average dividend rate of 6 per cent per annum, the estimated dividend earned on RM2,640 is RM152 for 22 months and about RM19,000 over 10 years.

With the additional tax relief of RM2,000 given to individuals earning a monthly salary of RM8,000 or below for the Year of Assessment 2015, the tax savings earned is RM420 using the tax bracket of 21 per cent.

A smart investor will use the additional funds wisely and diversify his/her investments that give higher yields. Those with some degree of discipline will use it to reduce household debts with high interest.

Having said that, there are those of us who will use it to buy more things. Thus it will be more prudent to leave the EPF deduction at 11 per cent and let your investment grow passively.

The global market is currently experiencing a slowdown, which is not expected to change in the next one year. Bank Negara Malaysia in its statement in November 2015 predicted the headline inflation to peak in the Q1 2016.

All of the above have to be taken into account when it comes to spending cash. In the upcoming volatile year, it may be worthwhile to hold cash close to your heart and spend it wisely.

Poovarni Rajagopal is a Chartered Accountant with the Malaysian Institute of Accountants and a fellow member of the Association of Certified Chartered Accountants (FCCA).

With a firm belief in freedom of expression and without prejudice, FMT tries its best to share reliable content from third parties. Such articles are strictly the writer’s personal opinion. FMT does not necessarily endorse the views or opinions given by any third party content provider.