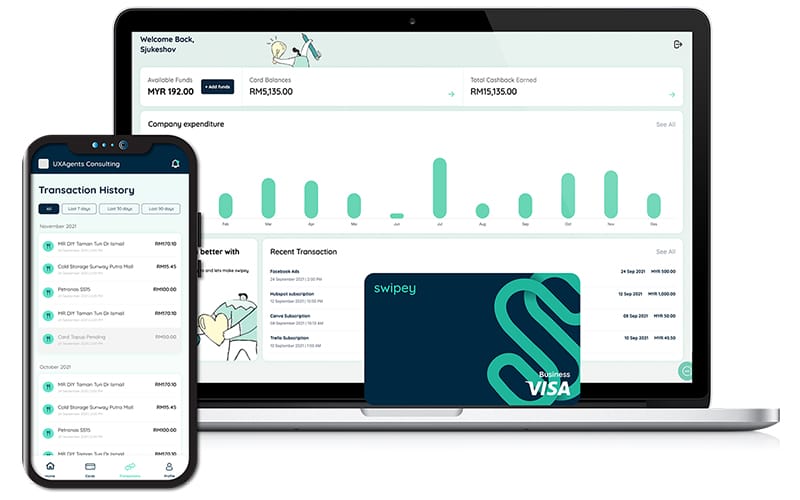

But a digital financial operating system that was first introduced in 2021 has been helping SMEs out of this maze.

For instance the system, called Swipey, helps the finance department keep tabs on an executive’s spending on his coporate credit card based on categories such as fuel or food, making budgeting easier.

Apart from that, it analyses the company’s finances. Call it a chief financial officer in your pocket.

Swipey is expected to reach an even wider audience under a recently struck deal with state enterprise Selangor Information Technology and Digital Economy Corporation (Sidec).

For a start, the 10 best performing start-ups in the two-month Juara e-Commerce programme will get the Swipey tool for free.

Swipey’s ties with Sidec began last year when it was awarded RM10,000 by the state enterprise for making it to the finals of its start-up accelerator programme.

Where it all started

The seed of an idea for Swipey was first planted when Kalyana ‘Mohan’ Teagarajan and Rouvin Thiruchelvam were working with SMEs.

They found that making financial operations in these companies more efficient was a challenge.

The lack of automation for processes such as billings, invoicing and recording of transactions meant that most of these businesses had to go through a long paper trail before they can close their books.

“From a financial operations point of view, it is terrible,” Mohan told FMT Business.

In his quest for a solution, the engineer who began a career in corporate finance at General Electric (GE) turned to his friend Rouvin, who had moved from GE to work on equity investment at CIMB.

Rouvin was facing the same problems in his work with business technology start-ups.

Mohan said a study of 125 companies showed that 94% of them required authorised personnel to use their personal credit cards for business expenses.

Of those surveyed, 64% tried but failed to get a corporate credit card while the others did not bother to try.

Putting it all together

Mohan and Rouvin teamed up in January 2021 and spent the following six months doing their research and developing the system.

They had a lot of help from part-timers, some of whom they recruited through Fiverr, a global online marketplace for freelance services.

In October that year, they found their first client. That was also when they hired their first full-time employees.

Mohan said their strategy was to work with partners that already had back-end infrastructure that they could build on, infrastructure that their soon-to-be partners Fasspay, Visa and HSBC Bank Malaysia Bhd already had.

He illustrates it simply: Rather than build a kitchen, they work with those that already have their own kitchens.

The collaboration with Visa enables Swipey to disburse payments when the prepaid corporate cards are used without the need for security such as a fixed deposit normally required by banks.

All the money deposited in a customer’s Swipey account sits in a regulated trust with HSBC in compliance with Bank Negara Malaysia requirements.

What lies ahead

These features have made Swipey the platform of choice for a collaboration with Malaysia Debt Ventures Bhd (MDV), a government vehicle for disbursing grants to businesses.

All transactions on Swipey are transparent, making it easy for MDV to ensure the money is well spent.

Instead of having to collect receipts and submit them when applying for a grant, MDV can now decide where the funds are allocated and do away with the claims process.

Swipey has had an “incredible” growth rate, Mohan said.

The company, which has 410 clients now, closed its first financial year with a US$100,000 (RM442,000) revenue.

Sunway Group recently came in as an institutional investor and Swipey is hoping to raise an additional US$1.5 million (RM6.61 million) by the end of the second quarter of this year.