Rakuten Trade Sdn Bhd vice-president of equity research Thong Pak Leng said key regional indices closed mixed prior to the release of the US consumer price index, which could influence the Federal Reserve’s (Fed) upcoming interest rate decision.

US Treasury secretary Janet Yellen had reportedly said yesterday that she was “feeling very good” about the country’s chances in avoiding a recession while still reigning in consumer price increases.

On the other hand, Thong said China’s consumer prices reverted to positive figures in August, signalling a possible reduction in deflationary pressures amid growing economic stability.

“As for the local bourse, it is advisable for investors to adopt a vigilant posture due to the growing global volatility and uncertainties.

“At present, the benchmark index’s valuations are currently inexpensive, hence, we believe bargain hunting may prevail,” he told Bernama.

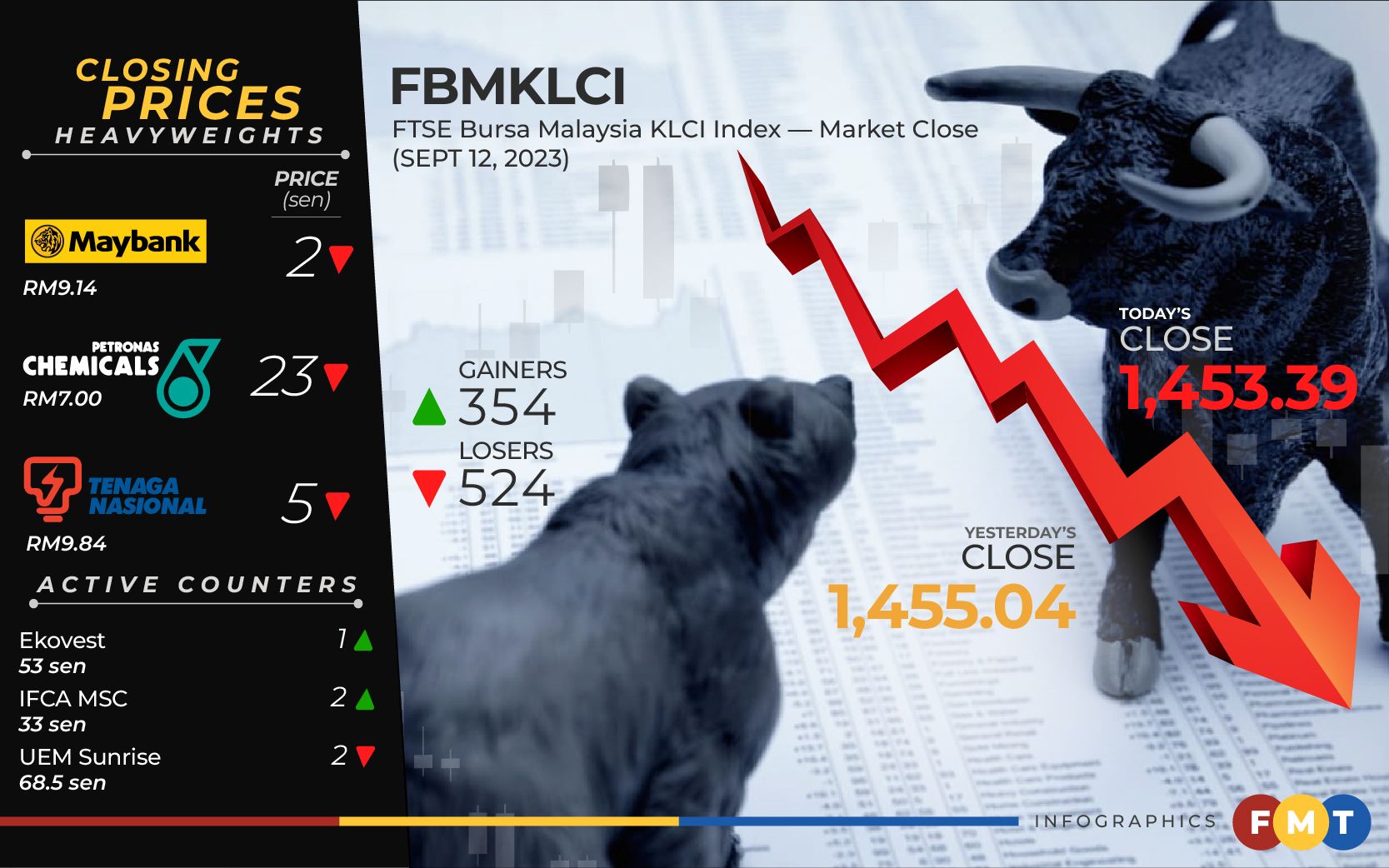

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) fell 1.65 points to 1,453.39 from 1,455.04 at yesterday’s close.

After opening 0.75 of-a-point lower at 1,454.29, the barometer index moved between 1,447.96 and 1,454.32 throughout the session.

On the broader market, decliners thumped gainers by 524 to 354, with 450 counters unchanged and 994 untraded.

However, turnover was marginally higher at 2.88 billion units worth RM1.99 billion against Monday’s 2.8 billion units worth RM1.64 billion.

Barring unforeseen circumstances, Thong anticipates the FBM KLCI to trend within the range of 1,445-1,465 for the week with immediate resistance at 1,465, and support at 1,440.

Bursa heavyweight counters Maybank edged down by one sen to RM9.14, Petronas Chemicals fell 23 sen to RM7 and Tenaga Nasional shed five sen to RM9.84, while Public Bank and AmBank were flat at RM4.24 and RM3.68 respectively.

Of the actives, Ekovest gained one sen to 53 sen, IFCA MSC added two sen to 33 sen, UEM Sunrise slid two sen to 68.5 sen and YTL Corp shed five sen to RM1.43.

On the index board, the FBMT 100 Index was 22.27 points easier at 10,380.37, the FBM 70 Index shed 74.6 points to 14,062.15, the FBM Emas Index was 23.73 points weaker at 10,700.1 and the FBM Emas Shariah Index slipped 23.16 points to 10,860.97.

Meanwhile, the FBM ACE Index improved by 4.88 points to 5,165.95.

Sector-wise, the financial services index reduced by 5.7 points to 16,436.92 and the industrial products and services index was lower by 1.95 points at 170.73.

Meanwhile, the energy index was 4.33 points better at 855.7 and the plantation index increased 26.34 points to 6,884.28.