Bank Muamalat Malaysia Bhd chief economist Afzanizam Abdul Rashid said the ringgit’s appreciation against major currencies indicates that foreign investors have become increasingly convinced about the prospects of the Malaysian economy.

He said the prevailing support level is currently at RM4.3050 against the US dollar, adding that should the US dollar/ringgit pair breach such a level, the next support level would be at RM4.1868.

“It remains to be seen how fast the ringgit will move to this level.

“But suffice to say, the appreciation has been quite steep with year-to-date performance showing a 6.2% gain against the greenback,” he told Bernama.

Meanwhile, SPI Asset Management managing partner Stephen Innes said the ringgit strengthened against the greenback today, buoyed by the early stages of a bearish consolidation phase for the US dollar ahead of next week’s non-farm payrolls (NFP) data.

He noted that one key factor keeping the US dollar under pressure and lending support to the ringgit was the dip in front-end yields, with the two-year US Treasury note yield continuing to slide modestly yesterday.

“What is particularly encouraging is how fully Asia foreign exchange has embraced this US dollar sell-off.

“However, whether we’ll see the US dollar vs ringgit inching down to the RM4.20 handle will largely hinge on next week’s NFP print. A weaker number could send the US dollar tumbling further,” Innes told Bernama.

On the potential loosening of US interest rates, Innes said the expectation of a 25-basis point cut in September was already factored into the market.

He stated that the real intrigue lies in whether the US Federal Reserve (Fed) will surprise with a 50-basis point cut, either in September or later.

“One way or another, the US dollar is likely to weaken. It is just a matter of how fast.

“If the Fed opts for the 50 basis points cut in September, you can bet the US dollar will be on a faster downward trajectory,” he added.

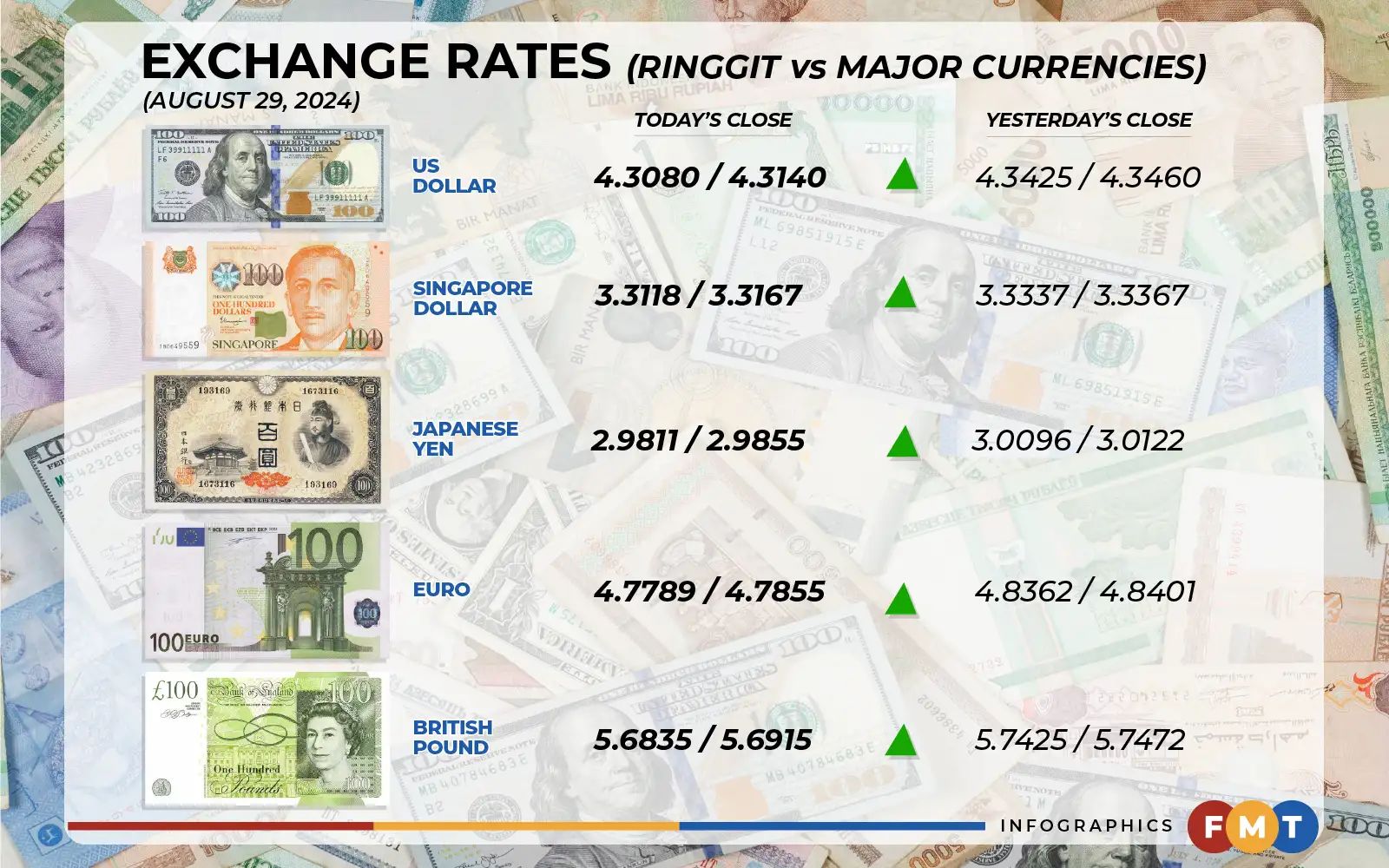

At 6pm, the ringgit surged to 4.3080/4.3140 against the greenback versus yesterday’s close of 4.3425/4.3460.

It strengthened against a basket of major currencies at yesterday’s close.

The local currency rose against the Japanese yen to 2.9811/2.9855 from 3.0096/3.0122 yesterday, surged against the euro to 4.7789/4.7855 versus 4.8362/4.8401 and soared against the British pound to 5.6835/5.6915 from 5.7425/5.7472.

At the same time, the local note traded higher against Asean currencies.

The ringgit advanced against the Singapore dollar to 3.3118/3.3167 from 3.3337/3.3367 and was higher against the Indonesian rupiah to 279.3/279.7 from 281.5/281.9.

It also gained vis-a-vis the Thai baht to 12.6911/12.7155 against yesterday’s close of 12.7709/12.7865 and jumped against the Philippine peso to 7.65/7.67 from 7.72/7.73.