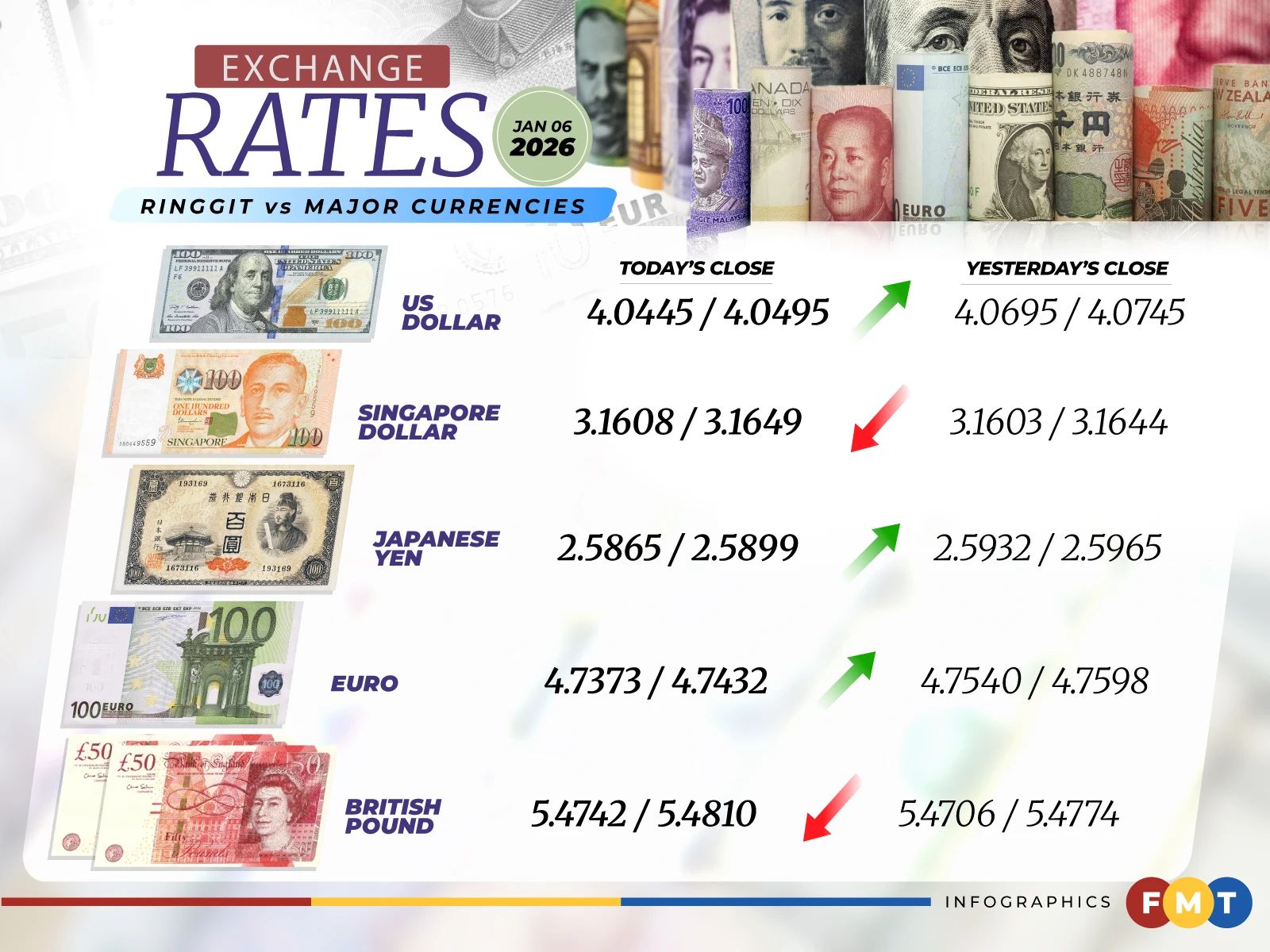

At 6pm, the local currency climbed to 4.0445/4.0495 versus the greenback from yesterday’s close of 4.0695/4.0745.

IPPFA Sdn Bhd’s director of investment strategy and country economist, Sedek Jantan, said that, given the situation, investors saw no meaningful spillover into global growth, energy supply, or financial conditions.

“As the initial safe-haven bid for the dollar faded, US yields and the greenback lost their defensive premium, allowing high-carry and high-beta currencies such as the ringgit to rebound.

“The resulting divergence between a weaker US Dollar Index (DXY) and resilient Asian currencies signals a short-lived risk-off shock rather than the start of a sustained global deleveraging cycle,” he told Bernama.

At the close, the ringgit traded mostly higher against a basket of major currencies.

It appreciated against the Japanese yen to 2.5865/2.5899 from 2.5932/2.5965 at yesterday’s close and strengthened vis-à-vis the euro to 4.7373/4.7432 from 4.7540/4.7598, but weakened versus the British pound to 5.4742/5.4810 from 5.4706/5.4774.

The local currency traded mixed against Asean peers.

It was up against the Philippine peso at 6.83/6.84 from 6.88/6.90 at yesterday’s close and rose versus the Thai baht to 12.9383/12.9592 from 12.9891/13.0109 previously.

However, the ringgit was slightly lower vis-à-vis the Indonesian rupiah at 243.1/241.7 from 243.0/243.5 yesterday and marginally lower against the Singapore dollar at 3.1608/3.1649 from 3.1603/3.1644.