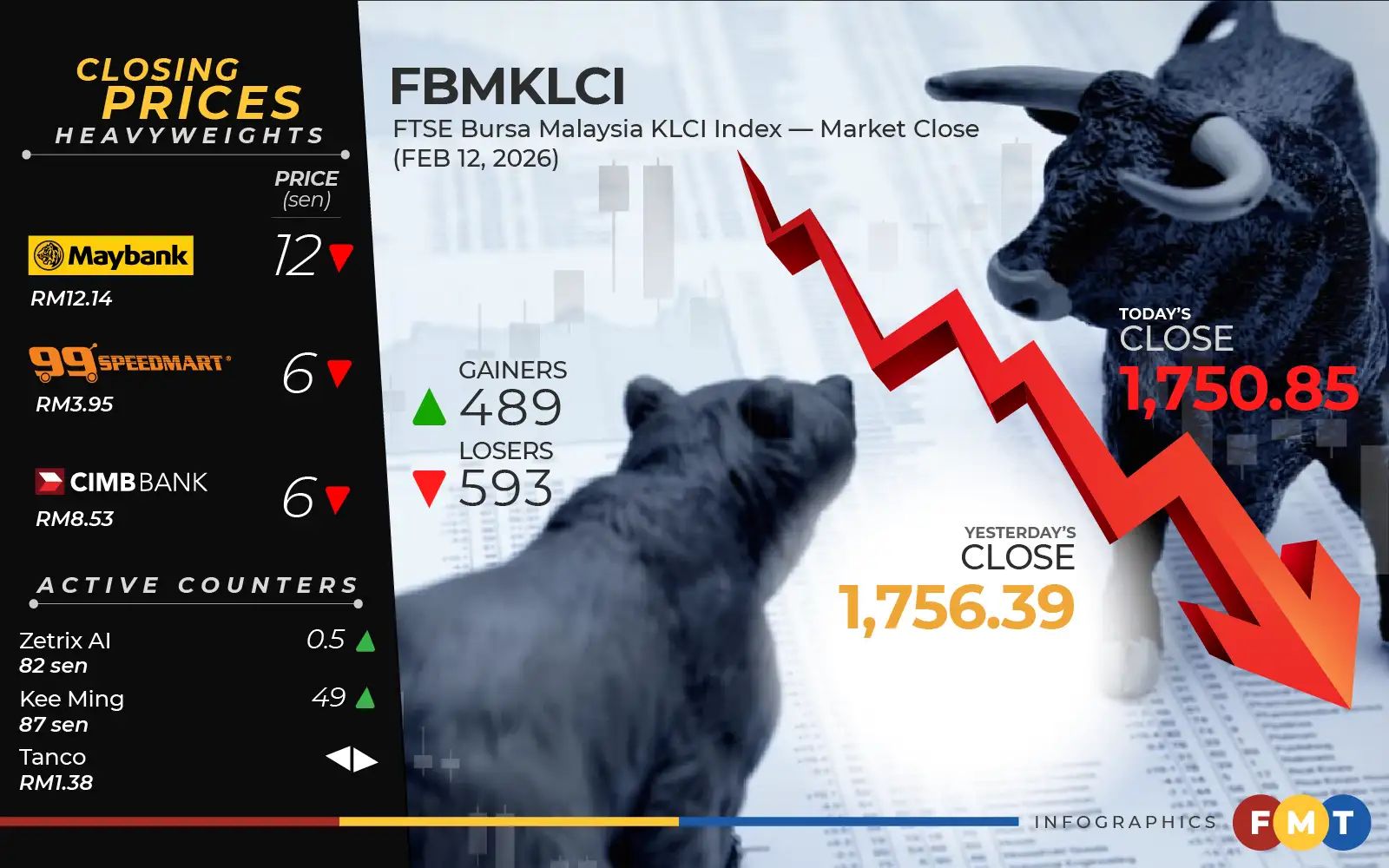

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) eased 5.54 points to 1,750.85 from Wednesday’s close of 1,756.39.

The benchmark index opened 1.30 points lower at 1,755.09 before moving to as low as 1,749.70 in early trade and to as high as 1,758.06 throughout the session.

Losers led gainers in the broader market 593 to 489, while 555 counters were unchanged, 1,059 untraded and 11 suspended.

Turnover inched up to 2.57 billion units worth RM2.79 billion from 2.55 billion units valued at RM3.06 billion yesterday.

Rakuten Trade Sdn Bhd vice-president of equity research Thong Pak Leng said the key index ended slightly lower amid light trading, as investors locked in gains after the previous session’s rally.

Across the region, markets were mixed, reflecting profit-taking in some bourses, although tech stocks in South Korea and Taiwan continued to attract strong demand.

Across the region, Hong Kong’s Hang Seng Index slid 0.97% to 27,001.71, while Singapore’s Straits Times Index rose 0.65% to 5,016.76. Japan’s Nikkei 225 edged down 0.02% to 57,639.84 and South Korea’s Kospi was 3.13% higher at 5,522.27.

“On the domestic front, trading was muted ahead of the CNY holidays. Nonetheless, support remained strong, with the index hovering around the 1,750 region.

“Maintaining levels at the 1,730-1,750 support zone would reinforce the positive outlook and support further upside potential. Thus, we expect the FBM KLCI to move within the 1,740–1,760 range into the weekend,” he told Bernama.

Among heavyweights, Maybank was 12 sen lower at RM12.14, CIMB, 99 Speed Mart and Press Metal lost six sen each to RM8.53, RM3.95 and RM7.69, while CelcomDigi was four sen lower to RM3.21.

On the most active list, Zetrix AI was 0.5 sen better at 82 sen, Kee Ming gained 49 sen to 87 sen, Tanco, Velesto and Borneo Oil were flat at RM1.38, 31 sen and one sen respectively.

The leading gainers were Fraser and Neave which was up 58 sen at RM32.88, Hong Leong Industries surged 42 sen to RM18.62 and Petronas Gas added 30 sen to RM18.54.

Leading decliners included Nestle, which erased 70 sen to RM110.60, United Plantations was 58 sen easier at RM29.62, Hong Leong Financial was 16 sen lower at RM22.68, Lysaght Galvanised removed 14 sen to RM2.25 and Solarvest lost 12 sen to RM2.25.

On the broader market, the FBM Top 100 Index dropped 24.72 points to 12,630.89, the FBM Emas Index shed 23.33 points to 12,805.44, and the FBM Emas Shariah Index declined 0.79 of-a-point to 12,261.64. The FBM Mid 70 Index rose 34.33 points to 17,591.62, while the FBM ACE Index increased 24.64 points to 4,775.13.

Sector-wise, the financial services index dipped 107.51 points to 21,762.87, the plantation index lost 30.86 points to 8,355.03, and the industrial products and services index inched up 0.22 of-a-point to 176.73. The energy index gained 1.56 points to 750.95.

The Main Market volume fell to 1.45 billion units worth RM250.71 billion from 1.49 billion units worth RM2.85 billion yesterday.

Warrants turnover shrank to 620.26 million units worth RM71.28 million from 642.03 million units valued at RM71.9 million previously.

The ACE Market volume firmed to 500.07 million units valued at RM206.99 million from 413.84 million units worth RM144 million yesterday.

Consumer products and services counters accounted for 196.33 million shares traded on the Main Market, industrial products and services (238.34 million), construction (149.51 million), technology (176.2 million), financial services (122.44 million), property (167.96 million), plantation (24.67 million), real estate investment trusts (25.7 million), closed-end fund (28,600), energy (119.8 million), healthcare (93.15 million), telecommunications and media (45.91 million), transportation and logistics (55.73 million), utilities (32.74 million), and business trusts (94,700).